Accounting Concentration

The Accounting Concentration provides a balance of breadth and depth in the discipline, with a view of producing accountants with a much-needed analytical and conceptual mind. Accountants are always in strong demand in the business world, and this Concentration is carefully designed to provide students not just with training in accounting, but with multi-disciplinary knowledge, analytical ability, information processing proficiency, communication skills, and a sound liberal education to excel in the accounting profession and other business fields.

- To provide students with in-depth training in the accounting discipline so as to give them adequate preparation for their careers in the field of accounting.

- To provide students with a multi-disciplinary knowledge and analytical ability which make them aware of the complexity of the business environment

- To develop students' information processing skills and communication skills

- To give students a sound liberal education which will render a sufficiently broad perspective to meet future challenges brought about by the ever-changing environment

- A balanced programme providing in-depth accounting training, broad-based business curriculum and a wide range of liberal studies

- A broad education seeking to build students' analytical ability, information processing proficiency and communication skills

- Full professional recognition from the Hong Kong Institute of Certified Public Accountants (HKICPA), Association of Chartered Certified Accountants (ACCA), Chartered Institute of Management Accountants (CIMA), CPA Australia, Association of International Accountants (AIA), and CMA Australia

- A special programme of summer classes allowing BBA (ACCT) students to join full-time semester-long spring internships with Big4s and other well-known CPA firms, or overseas exchanges without delaying their graduation

- Plenty of scholarship awards available exclusively to BBA (ACCT) students

- Additional graduation options including a Double Concentration within the BBA, or a Minor in a non-business discipline

from AY2020/21 onwards

ACCT 2005 Intermediate Accounting I

ACCT 2006 Intermediate Accounting II

ACCT 3005 Cost & Management Accounting I

ACCT 3006 Hong Kong Taxation

ACCT 4005 Advanced Accounting I

ACCT 4006 Auditing I

LLAW 3005 Company Law

For the HKICPA/ACCA recognition/ exemption:

LLAW3007, LLAW3005, ACCT3006

LLAW3007 Principles of Law

LLAW3005 Company Law

ACCT3006 Hong Kong Taxation

MUST be completed at HKBU

ACCT3007

ACCT3007 Cost and Management Accounting II

REQUIRED for HKICPA/ ACCA recognition/ exemption - students need to take this course using the units for Free Elective Courses

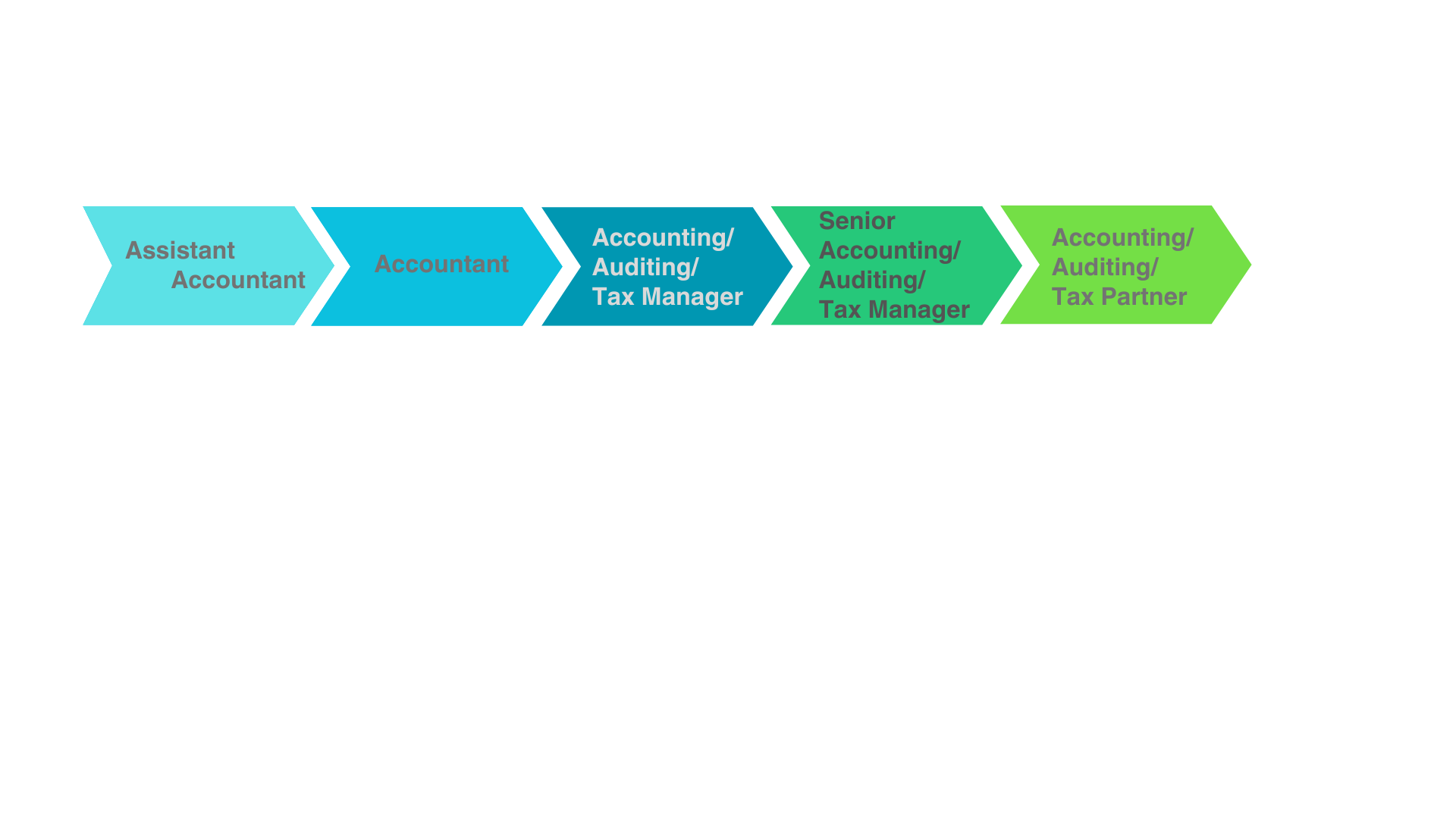

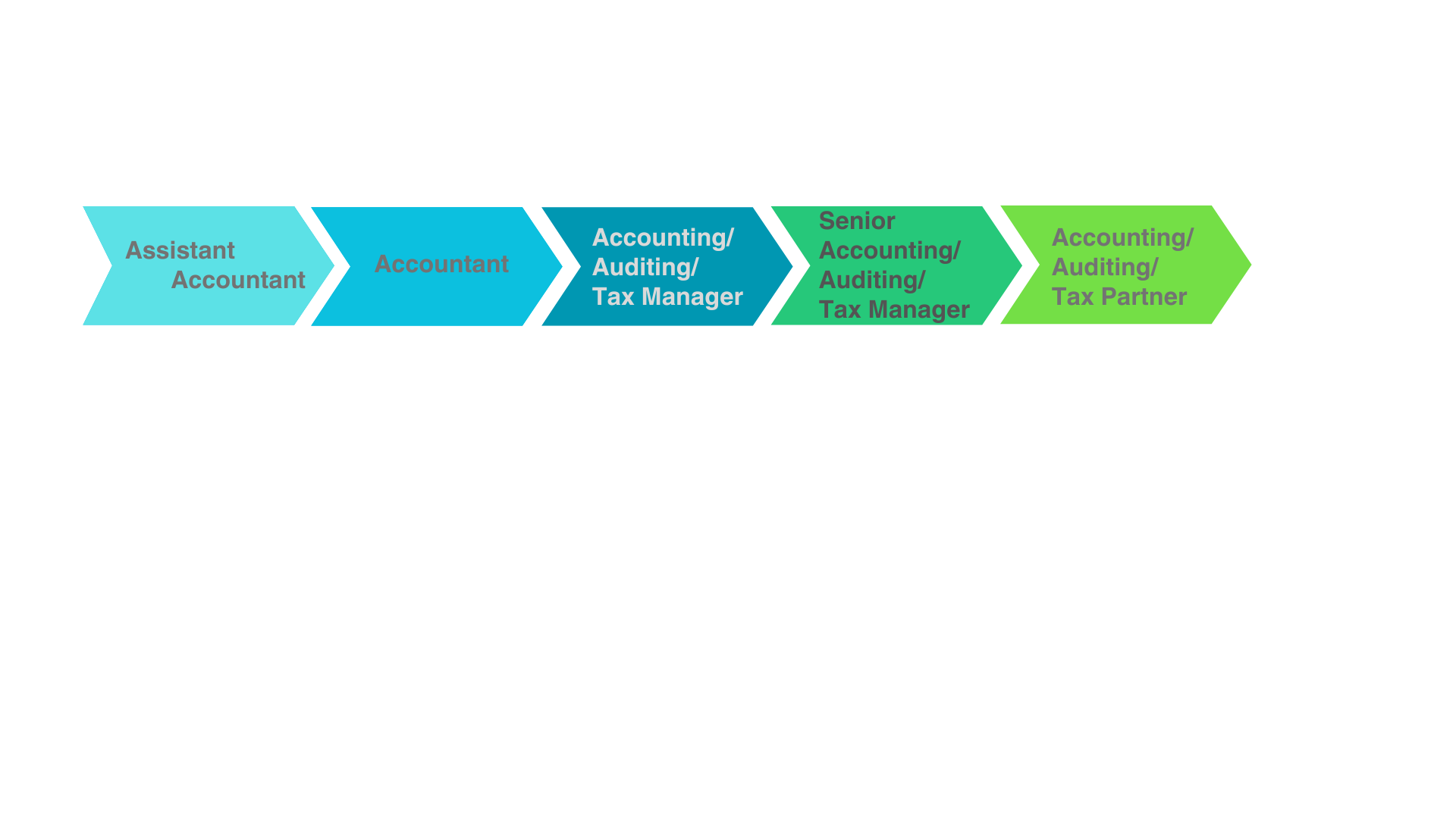

Graduates can develop their careers in professional accounting firms and in government, commercial and industrial sectors.

- Hong Kong Institute of Certified Public Accountants (HKICPA)

Graduates are qualified for exemption from all 10 Associate Level Modules of the new HKICPA Qualification Programme (QP). BBA (Hons) Accounting Concentration is a HKICPA accredited accounting degree programme.

- Association of Chartered Certified Accountants (ACCA)

Graduates are exempted from 9 out of 13 papers of the ACCA Qualification Exam. It is the maximum exemption given by ACCA.

- Chartered Institute of Management Accountants (CIMA)

Graduates are exempted from 11 out of 16 exams of the CIMA Professional Qualification.

- CPA Australia

Graduates are exempted from all the 6 Foundation Level exam papers and are eligible to apply for the CPA Australia Associate membership.

- Association of International Accountants (AIA)

Graduates are exempted from 12 out of 16 exam papers of the AIA Professional Accountancy Qualification. It is the maximum exemption given by AIA.

- Institute of Certified Management Accountants (CMA Australia)

Graduates are exempted from all the 16 subjects of the ICMA Program and are eligible to apply for the designation of Graduate Management Accountant (GMA).